How NOT to Mitigate Financial Issues in a Security Clearance Case

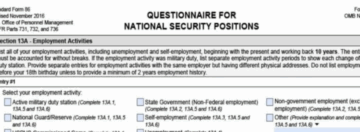

In a previous post “Financial Issues Still the Biggest Reason for a Clearance Denial” I explained what the adjudicative guidelines stated regarding concerns about financial issues and ways for applicants to provide mitigation. Yet, it still seems almost every day we get comments or questions on the site from applicants asking about what they should do about their specific financial situation. The guidelines have not changed, nor have the mitigating factors changed. On that note, in a recent Department of Energy Hearing and Appeals case the judge upheld the security clearance denial because the applicant failed to provide any mitigation that might overcome the financial issues. Here is a brief summary:

The individual has a history of financial irresponsibility that includes evictions, civil court judgments, bankruptcy, and a failure to file income taxes. His monthly net income is less than his financial obligations. Despite this negative cash flow, he admitted to spending $30 to $40 on gambling every other weekend. During the hearing he testified that he is “trying to do better” with his finances. However, it appears that he did not learn from past mistakes, had no plan in place, and had yet to start paying the current debts still owed and incurred additional debt in the form of car loans. Add in his rent, child support payments, and other bills and it did not paint a very good picture of financial responsibility. This case is a good example of how NOT to mitigate financial considerations for a security clearance denial.

In 2015, I was late on my mortgage and car loan about 4 times not exceeding 30 days. As soon as I got a job, I became current. I forgot to mention that on my sf86 but when I had the interview I told the investigator about my mortgage loan and that I didn’t remember how many times I was late. When he called me two days later to update some info, I also told him about my car loan…and he said, that didn’t matter. He only wanted the mortgage info. I gave him estimated dates of when it happened. Is this an issue? It was so insignificant that I forgot about it. Honestly.

If that is the only issue and it has been resolved then you should be okay. The more serious issue is the appearance of not disclosing it on the form, but it can be overlooked if no other issues are present.

I have seen additional info added during the investigator meeting. Marko was right (as usual). But I wouldn’t move forward saying it is insignificant. Can it happen? Absolutely. But don’t downplay it. Just own it. No income, generally means no outflow. If it is explainable it is understandable. FICO scores recover much faster under the new rules. As long as you are currently average or better and you show a trend of paying on time…you should be fine. You MAY sign a conduct letter acknowledging the finances require monitoring.

Thank you. Very helpful.